ajr_pictures/iStock by means of Getty Visuals

Financial investment thesis

Scheduling Holdings’ (NASDAQ:BKNG) success for Q1 FY12/2022 highlighted positive administration commentary about gross bookings in April 2022 achieving pre-pandemic levels. Despite this kind of positive details, the shares have reacted tiny. We believe that the price of dwelling crisis will hit holiday getaway habits negatively into H2 FY12/2022, slowing the tempo and scale of recovery. With consensus estimates on the lookout much too bullish, we price the shares as neutral.

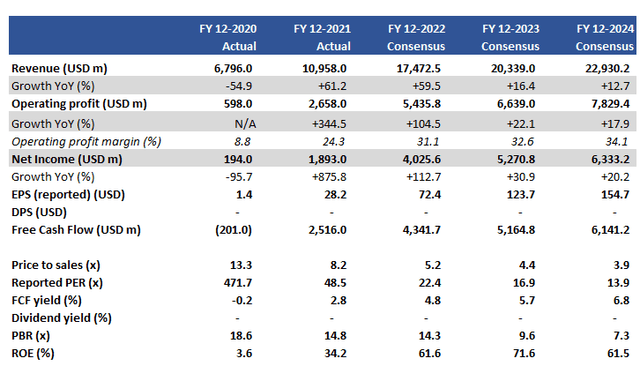

Important financials and consensus earnings estimates

Vital financials and consensus earnings estimates (Company, Refinitiv)

Our objectives

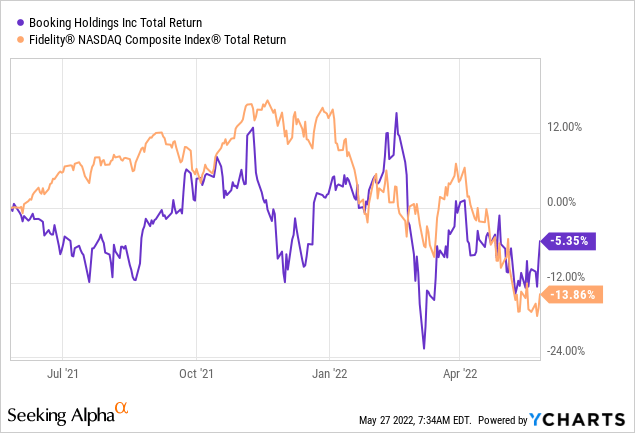

The loosening of travel constraints article COVID19 should herald a period of time of strong demand for Scheduling Holdings, coming in the type of pent-up need from the two business enterprise and leisure travelers. Booking’s shares have outperformed the NASDAQ Index in the past 12 months but not by a incredibly big margin.

In this piece we want to assess the pursuing:

- Assess the level of existing need for vacation, and its outlook supplied the softer outlook in consumer sentiment.

- Revisit our promote recommendation from March 2021, taking into account consensus estimates for the up coming two yrs.

We will just take each one in change.

Demand stays gentle

The conclusion we appear to is that however for the travel field, demand currently remains softer than hoped. With a lot of areas of the planet facing a expense of living disaster, and the Russian invasion of Ukraine ensuing in a major increase in the price of standard items, we believe this will have a major damaging influence on the future restoration of leisure vacation.

We discover information disclosed by the UNWTO (United Nations Globe Tourism Business) as 1 indication of the tourism industry’s overall health. Even though the information accessible is not totally up to date, their Tourism Restoration Tracker emphasize favourable knowledge YoY in the recovery in travel sentiment and shorter-phrase rental demand for April 2022. Even so, what continues to be deeply destructive YTD selection from precise air reservations down 70% YoY, lodge bookings down 69%, and low hotel occupancy charges at 58%. There is evidence of restoration elsewhere, for instance, Japan has seen a 1,185% YoY boost in abroad tourists in April 2022 but this continues to be down 95% from the amounts viewed in pre-pandemic April 2019. The hurdle prices versus pre-COVID19 levels are extremely large.

The hazard from soaring expenditures will influence customers as effectively as the hospitality trade by itself, which is also experiencing rising input prices in electrical power, foodstuff and wine, and payroll. A opportunity fall in provide will also be a damaging for journey internet sites as service provider volumes start off to drop off.

Organization vacation seems to be faring greater. American Specific International Business Travel (which is merging with SPAC Apollo Strategic Development Cash (APSG)) commented that the 1st 3 weeks of April 2022 noticed transactions get to 72% of 2019 levels. There seems to be stronger momentum right here versus leisure with the company planet returning to journey. The concern below would be that with small business journey earning up around 20% of the complete market, the industry can only be actually saved with leisure volumes returning.

The consensus seems as well bullish (once again)

In our earlier remark in March 2021, we felt that consensus forecasts have been also bullish, especially for organization travel recovery and we rated the shares as a sell. This time, we believe consensus is when all over again being also bullish for the subsequent causes.

For FY12/2022, we consider the ‘bumper’ summer time of demand from customers is unlikely to be sustainable. In the outcomes call for Q1 FY12/2022, management commented that at Scheduling.com gross bookings for the summer time period had been in excess of 15% larger than at the exact same stage in 2019 – but a large share of these bookings had been cancelable and the reserving window had recovered (people scheduling forward were being similar to pre-pandemic amounts, consequently have ample time to cancel). The critical difficulty is more than how sustainable this need profile is compared to a 1-time restoration from pent-up desire. With the current macro atmosphere, we can’t envisage a continuous restoration that spills in excess of into H2 FY12/2022.

What also would seem also bullish is consensus estimating that the firm’s once-a-year revenues will preserve recording double-digit expansion into FY12/2023 (+16.4% YoY) and FY12/2024 (+12.7% YoY). In the heady times of progress concerning FY2015-2019, the organization grew income by 13.% YoY CAGR – we come across it extremely hard to imagine that it can match this kind of advancement premiums thinking of inflationary cost pressures, falling benchmarks of residing, and increased hurdles YoY.

The two current places of weak spot for the corporation are the Asia market place and prolonged-haul intercontinental journey. With travel limitations getting lifted, there will be a surge in demand but the situation will be the level of restoration in ADR (ordinary every day charges) in accommodation which will just take some time. Also, in the environment of distant function, the need to have for business vacation has fallen which will have a long lasting impact on global journey volume.

Booking Holdings could goal to maximize marketplace share to speed up topline progress, but we think the all round market pie requirements to develop for the enterprise to perform per consensus estimates. This does not search very likely to us at this level.

Valuations

On consensus estimates (in the desk above in the Key Financials area) the shares are buying and selling on a absolutely free funds movement generate of 5.7% for FY12/2023. This is an eye-catching produce and would spot the shares in the undervalued class. Nevertheless, with consensus estimates showing as well bullish we imagine a more practical produce to be around 4%. As a result, the shares search additional quite valued.

Hazards

Upside possibility arrives from a sustained desire restoration in leisure travel as limitations are lifted and customers get started to allocate paying on holidays. The business has witnessed powerful quantities in April 2022, and if these kinds of tendencies proceed the outlook is positive.

A rather swift close to the Russian invasion of Ukraine will assist in lifting consumer sentiment as very well as putting some downward pressure on inflation (notably for agricultural foods price ranges).

Downside hazard comes from the improve in the charge of dwelling which leads to tourists ‘trading down’. The choice of accommodation concentrates on decrease priced inventory ensuing in slipping ADR and revenues.

A protracted conflict in Europe pitfalls getting other sovereign nations finding included, which would spot pressure on the European vacation marketplace. The cancellation level may perhaps increase as a end result.

Conclusion

Despite encouraging opinions from management about modern investing, the firm’s shares have reacted minor. We put this down to the market place assessing the danger of a international recession and the destructive impact this will have on getaway actions. Although we be expecting a restoration for the company, we feel the tempo and scale will be slower and smaller sized than recent consensus estimates. With current market expectations remaining fairly large, we now price the shares as neutral.

More Stories

How to Prepare For an Adventure Holiday

Why Malta Is the Most Affordable Place for a Holiday Travel

All About Travel Agencies