Ideally, your all round portfolio should beat the market typical. But in any portfolio, there will be blended results involving unique shares. So we wouldn’t blame long phrase Vacation + Leisure Co. (NYSE:TNL) shareholders for doubting their final decision to keep, with the inventory down 49% more than a half 10 years. Much more lately, the share selling price has dropped a even further 9.6% in a thirty day period.

The new uptick of 4.7% could be a optimistic indicator of matters to come, so let’s take a great deal at historic fundamentals.

Check out our most up-to-date examination for Travel + Leisure

Though marketplaces are a strong pricing mechanism, share costs reflect trader sentiment, not just underlying business effectiveness. By comparing earnings for every share (EPS) and share value alterations over time, we can get a truly feel for how trader attitudes to a organization have morphed in excess of time.

In the course of five yrs of share value development, Travel + Leisure moved from a reduction to profitability. Most would consider that to be a excellent matter, so it’s counter-intuitive to see the share price declining. Other metrics may perhaps improved make clear the share price tag move.

Arguably, the revenue drop of 9.% a year for half a ten years suggests that the enterprise can’t expand in the prolonged term. That could describe the weak share price tag.

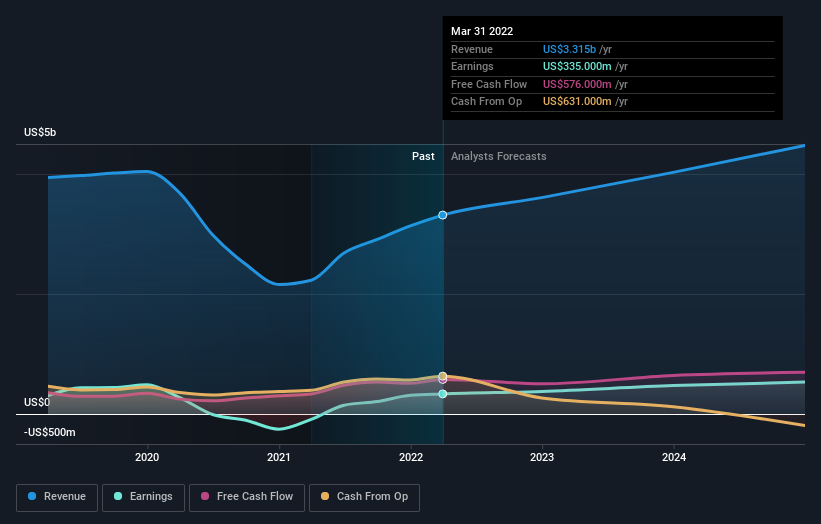

You can see below how earnings and income have altered over time (learn the specific values by clicking on the graphic).

We know that Travel + Leisure has improved its bottom line recently, but what does the long term have in shop? So we advocate checking out this totally free report displaying consensus forecasts

What About Dividends?

As nicely as measuring the share price return, investors should also take into account the overall shareholder return (TSR). While the share selling price return only reflects the modify in the share cost, the TSR contains the worth of dividends (assuming they have been reinvested) and the reward of any discounted cash raising or spin-off. Arguably, the TSR provides a a lot more detailed image of the return created by a stock. We take note that for Travel + Leisure the TSR over the final 5 yrs was 32%, which is far better than the share cost return described over. The dividends compensated by the company have thusly boosted the full shareholder return.

A Different Standpoint

When the broader market misplaced about 12% in the twelve months, Travel + Leisure shareholders did even even worse, getting rid of 20% (even which include dividends). Getting explained that, it is inevitable that some stocks will be oversold in a slipping marketplace. The crucial is to retain your eyes on the fundamental developments. On the shiny facet, prolonged phrase shareholders have made revenue, with a obtain of 6% per yr in excess of half a decade. If the fundamental facts continues to reveal extended term sustainable advancement, the latest sell-off could be an chance truly worth thinking of. I discover it really intriguing to search at share selling price over the long time period as a proxy for organization functionality. But to definitely achieve insight, we have to have to contemplate other facts, too. Scenario in point: We’ve noticed 3 warning signs for Travel + Leisure you really should be aware of, and 1 of them is a little bit relating to.

If you are like me, then you will not want to overlook this absolutely free listing of developing providers that insiders are obtaining.

Make sure you take note, the sector returns quoted in this short article replicate the sector weighted average returns of shares that at the moment trade on US exchanges.

Have feed-back on this write-up? Anxious about the information? Get in contact with us directly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Basically Wall St is standard in mother nature. We offer commentary dependent on historical data and analyst forecasts only using an impartial methodology and our articles are not intended to be financial information. It does not represent a suggestion to obtain or sell any inventory, and does not acquire account of your aims, or your economical problem. We goal to bring you extended-time period targeted analysis pushed by elementary knowledge. Be aware that our examination may not factor in the newest selling price-sensitive corporation announcements or qualitative materials. Only Wall St has no situation in any shares talked about.

More Stories

How to Prepare For an Adventure Holiday

Why Malta Is the Most Affordable Place for a Holiday Travel

All About Travel Agencies