amriphoto/E+ by using Getty Photographs

Thesis

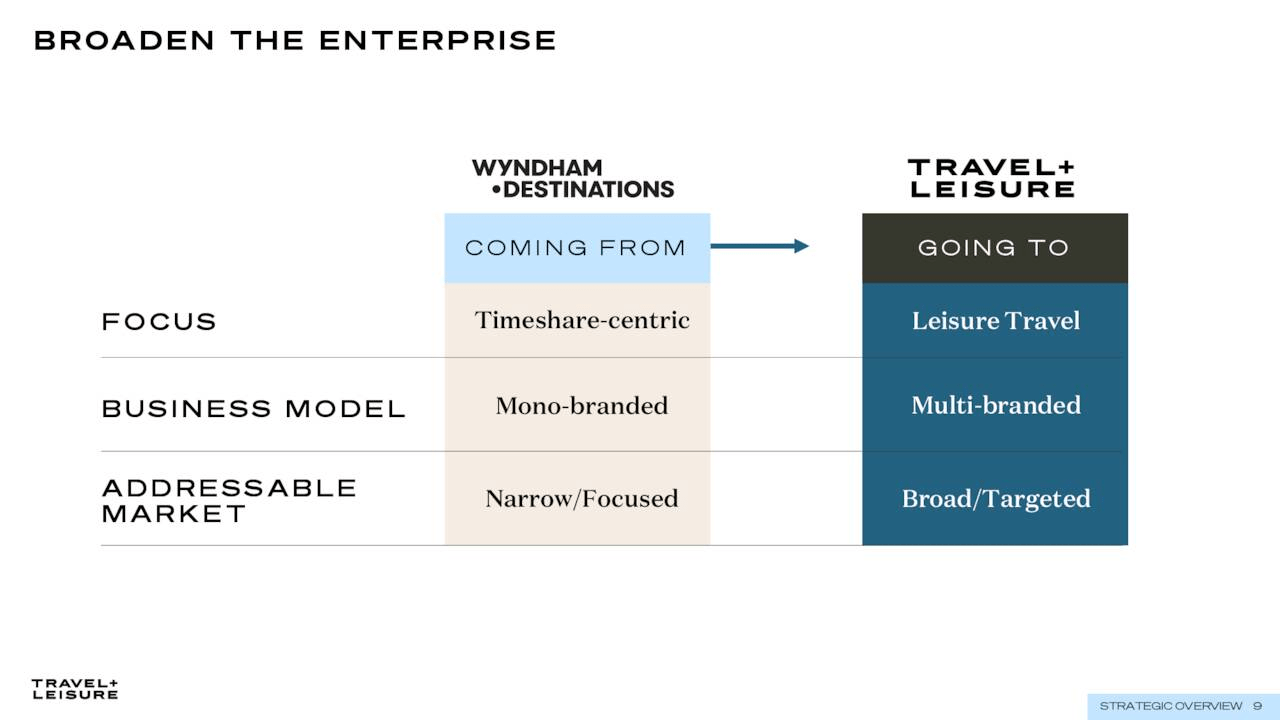

Vacation + Leisure (NYSE:TNL) is fairly an appealing new conglomerate in the journey marketplace. Formerly portion of Time Magazine proprietor Meredith Co (GTN)(IAC), T+L the journal was obtained by Wyndham Hotels (WH) spin-off Wyndham Locations, which are mainly timeshare vacation resort functions, but Wyndham took the well-known magazine’s identify. The aim of the acquisition and rebranding beneath the T+L banner was for multiple reasons. Initial, move away from destructive timeshare stigma because of to legal rights and expense. 2nd, raise visibility of the system less than one banner. Third, boost operational effectiveness by integration, all even though escalating consumer base. The corporations are now capable to get the job done together, fairly than alongside each and every other, and management expects these synergies to travel progress and earnings.

I hope the benefits to be favorable, but there is loads of competitors in the “life style journey” segment, this kind of as Airbnb (ABNB). As investors, it will be crucial to select parts of the industry that are currently weak, but provide upside opportunity as general performance returns to form. The uncertainty close to TNL features a steep undervaluation all whilst synergies concerning functioning units will permit the enterprise to outperform. Whilst monetarily the jury is even now out, the financial investment is certainly really worth consideration above the future couple quarters thanks to the favorable valuation.

TNL

The New Journey + Leisure

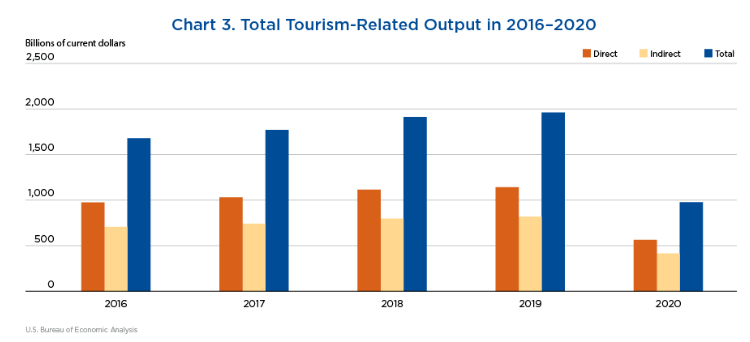

Prior to merging, the two individual entities have been highly specialized, a person a timeshare company and the other a travel magazine. With print media getting a hit over the past number of many years, maybe as a result of declines in political desire, Vacation + Leisure invested closely into their online system. Also, the manufacturer proceeds to offer you yearly award rankings of the top motels, destinations, and regions of the world. The publication is typically rated as the major excellent title in the field and has earned plenty of lovers the world in excess of. Altogether, if travel attractiveness increases to levels viewed prior to the pandemic, T+L is set to increase with the industry. On the other hand, timeshares are a diverse tale as their economic viability and acceptance wanes over time, primarily with steep competitors from trip rentals and traditional lodge/motel.

USBEA

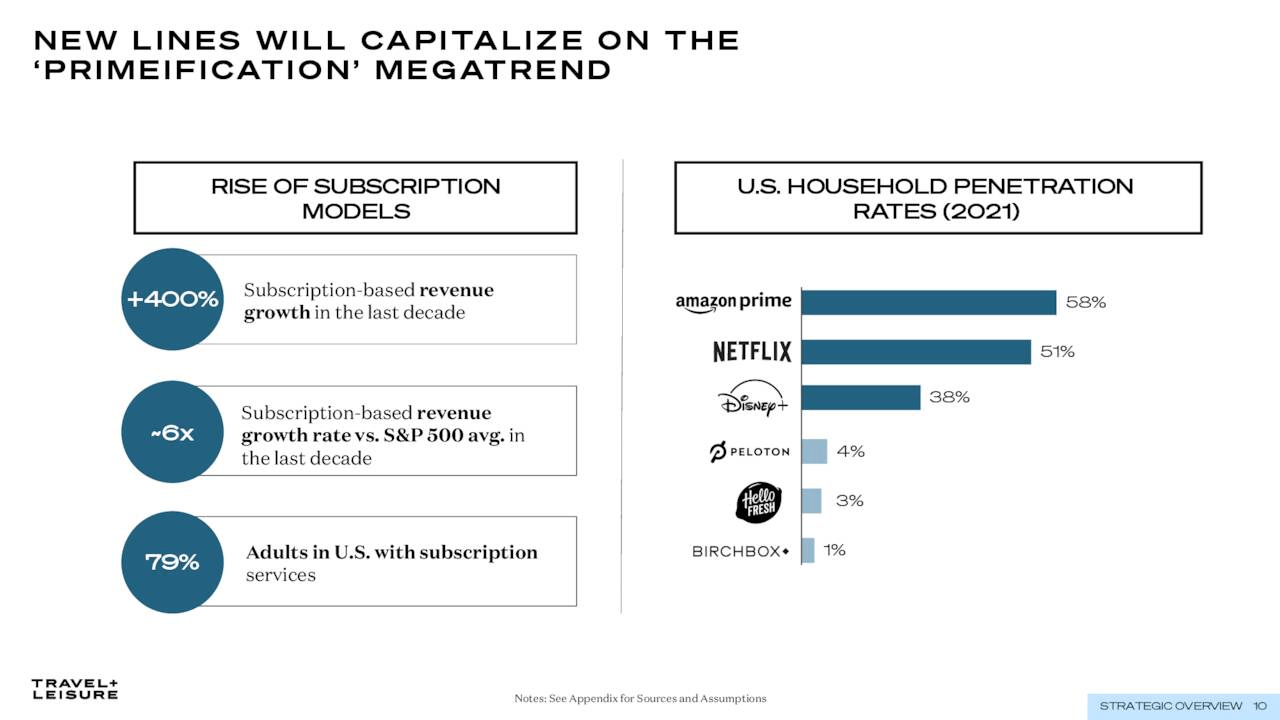

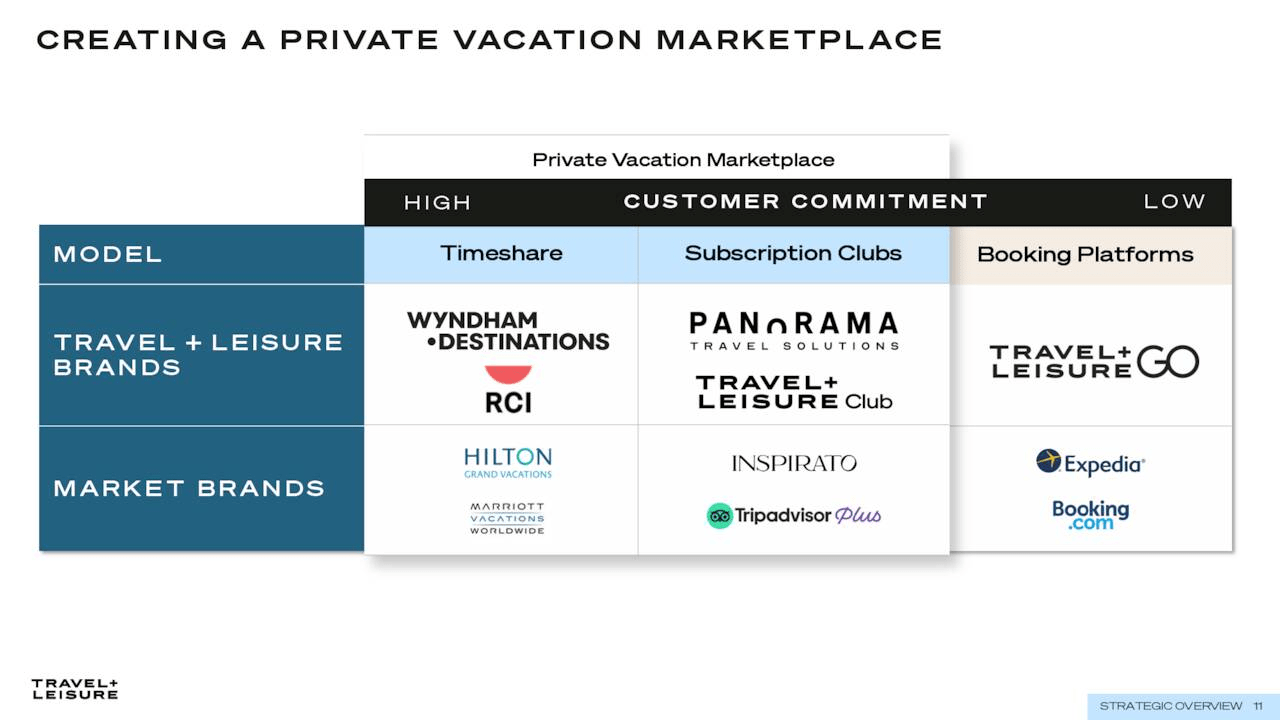

To deal with some troubles, the corporation is shifting business techniques, opting to go with the well-known membership product. This consists of the many Wyndham Destinations Clubs, Journey + Leisure Club, and Journey + Leisure Go. Wyndham Club and other people, backed by the substantial catalog of timeshares within just the RCI system, now allow for users to select a variety of resorts, relatively than remaining caught at a one one. Utilizing a details fashion, various tiers of memberships have varying awards, but members get locked into very long-time period contracts.

To have a lot more lenient and fewer baffling offerings, TNL now offers Vacation + Leisure club, a currently $15 ($19.99 when not on sale) month-to-month subscription that presents accessibility to trip discounts, non-public concierge, and curated itineraries. This membership is not contracted and can be canceled at any time. However, this system nevertheless favors far more affluent clients who are equipped to vacation a lot more commonly, considerably like timeshares or vacation credit card rewards.

As this sort of, a third support system was additional, TNL Go. The web-site delivers in depth and many itineraries for vacationers and frequently presents hyperlinks to join TNL Club. Even though extra of an middleman among the journal web-site and club, probably the company will appear to build on line booking characteristics comparable to Scheduling.com (BKNG) or Expedia (EXPE). The company also offers the Panorama program system that enables condominiums, flats, and/or resorts and other holiday rentals to have their very own site platform for bookings.

There are other sections I could focus on, but the gist is that the magazine web-site drives website traffic and the want to journey, then initial vacationers will appear at itineraries on the T+L Go website. Immediately after experiencing a holiday vacation, individuals who want to proceed traveling or vacationing through the yr will be a part of T+L Club. Then, the top-tier of earners or retirees with further money will be the major purchasers of timeshare club memberships. This constructive opinions loop makes it possible for for the synergies concerning models that I mentioned earlier. Whilst, one particular will have to be considerate of excess shelling out on the tech platforms, and one particular consolidated web page or membership could be improved. I am certain the company will evaluate this contingency as properly.

TNL

TNL

Financials

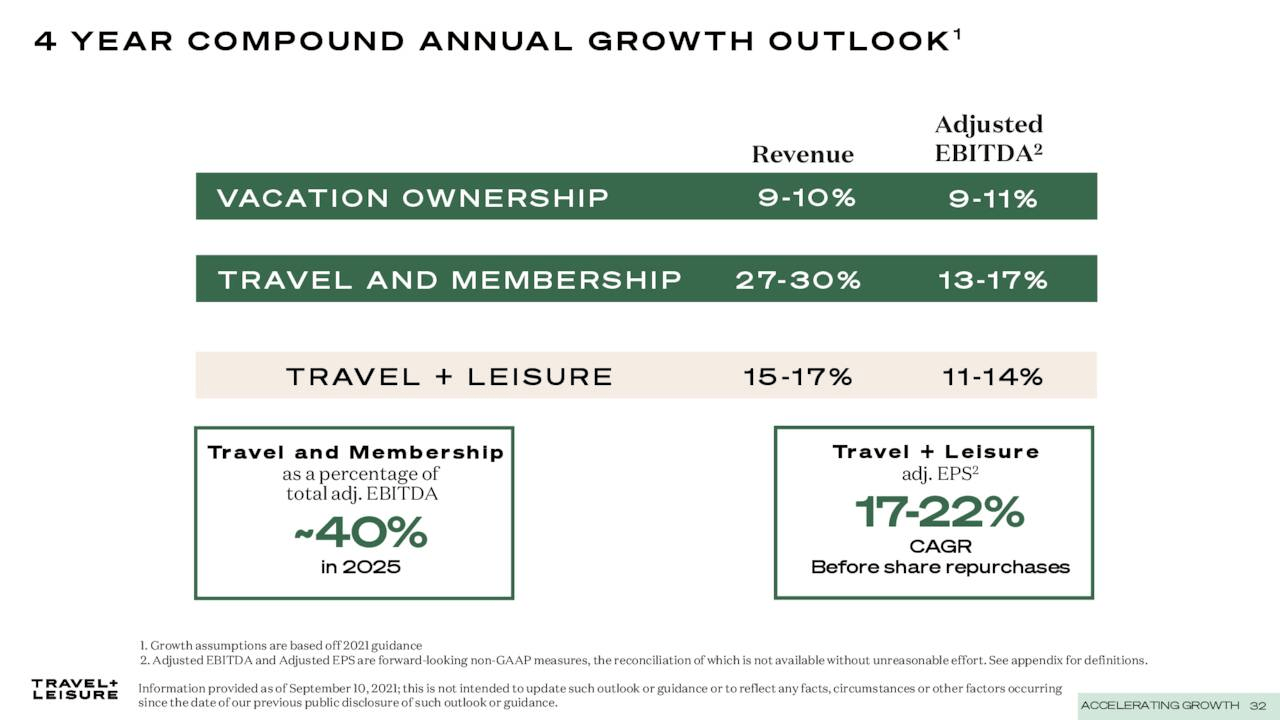

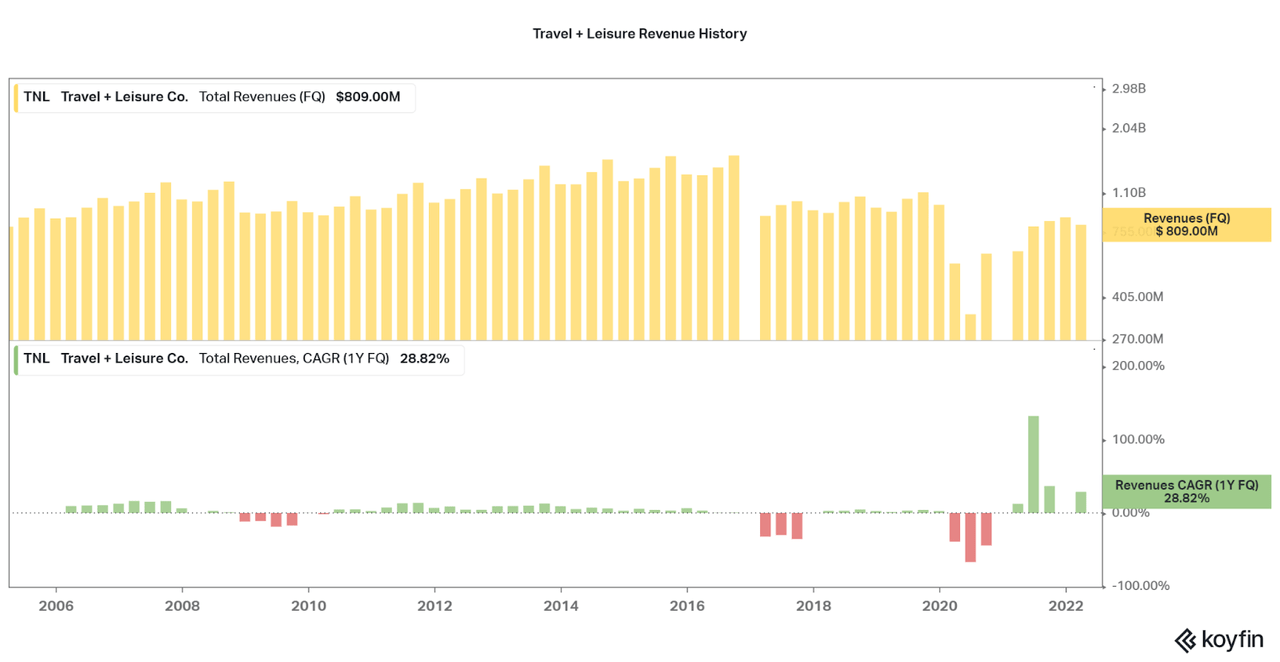

So, how do these alterations impact the financials? Although the company expects considerable progress in excess of the up coming 4 many years, we can make very little insights into irrespective of whether this is further than prior functionality. So considerably, revenues have rebounded to marginally considerably less than 2019 revenues, and are significantly less than what the Wyndham small business noticed on its individual prior to merger. Nonetheless, most vacation sector names are nevertheless receiving fewer revenues than prior to the pandemic. As these kinds of, I believe it will acquire some time to be in a position to break down the revenues and advancement possible of the enterprise.

For the second, the driving catalyst will only be a return to pre–pandemic vacation ranges. Problems with inflation and recessions will also hinder the stock, so the return will possible be slower than envisioned. However, in the long operate, I do not believe the organization will return to the revenue advancement noticed in the 2010-18 period, and will in truth improve faster.

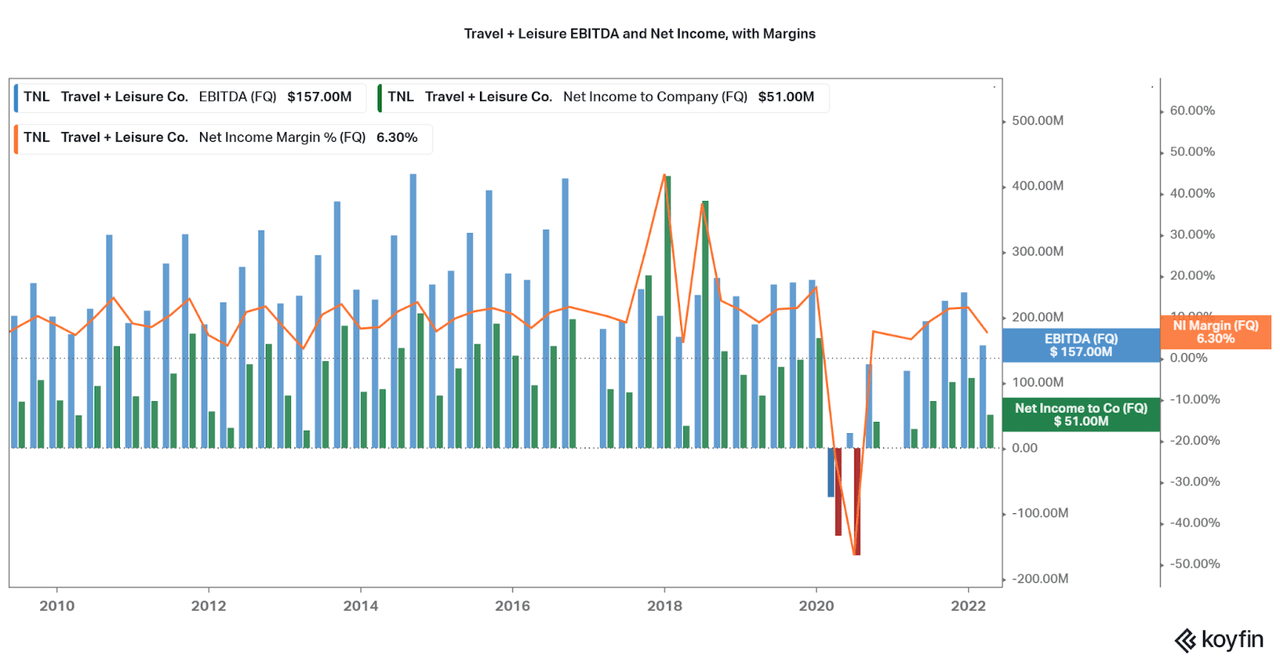

TNL Koyfin

Even though 2020 was achieved with steep losses at first, I locate that T+L was ready to retain powerful profitability throughout the afterwards levels of the pandemic. In reality, two quarters had been negative, but then by 2021, the internet money margin returned earlier mentioned 5%, with some quarters hitting 10%. The timeshare field has a background of slow, but worthwhile expansion, and it appears to be this pattern allowed for basic safety into 2021. I also think the magazine phase remained robust as well, as the desire for vacation written content did not subside, just the functionality to vacation I know I planned out numerous visits for once I could journey once more above the earlier two a long time.

Koyfin

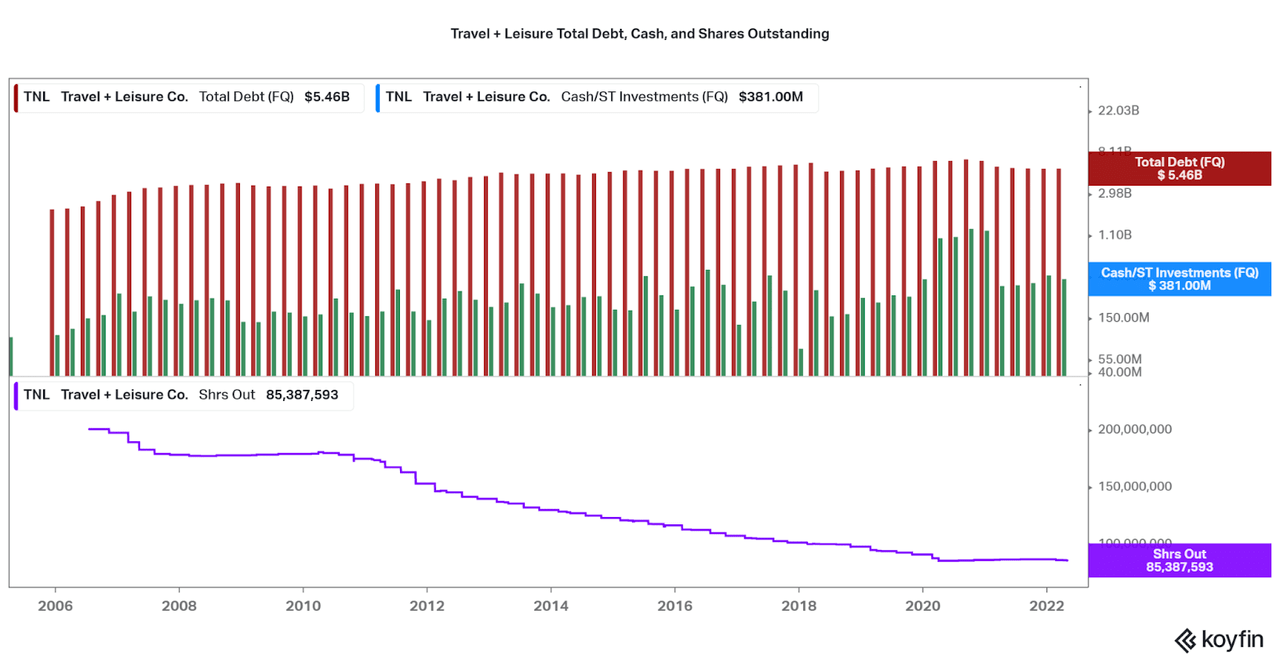

Getting a glimpse at the harmony sheet also paints a contrasting photograph. Although there is important personal debt on the equilibrium sheet, funds amounts truly enhanced in 2020/21. I like to see that credit card debt is not increasing as a result of the pandemic, and this may possibly be a positive advantage to the recently merged corporations. Even more, the company had a heritage of steadily decreasing the all round share depend, and dilution did not come about all through the pandemic. Though I imagine TNL provides a protected equilibrium sheet, I would continue on to retain observe alongside with the rest of the financials as vacation returns to ordinary. There is a great deal uncertainty in the industry and financial state, and no require to rush into an financial commitment.

Koyfin

Price tag and Valuation

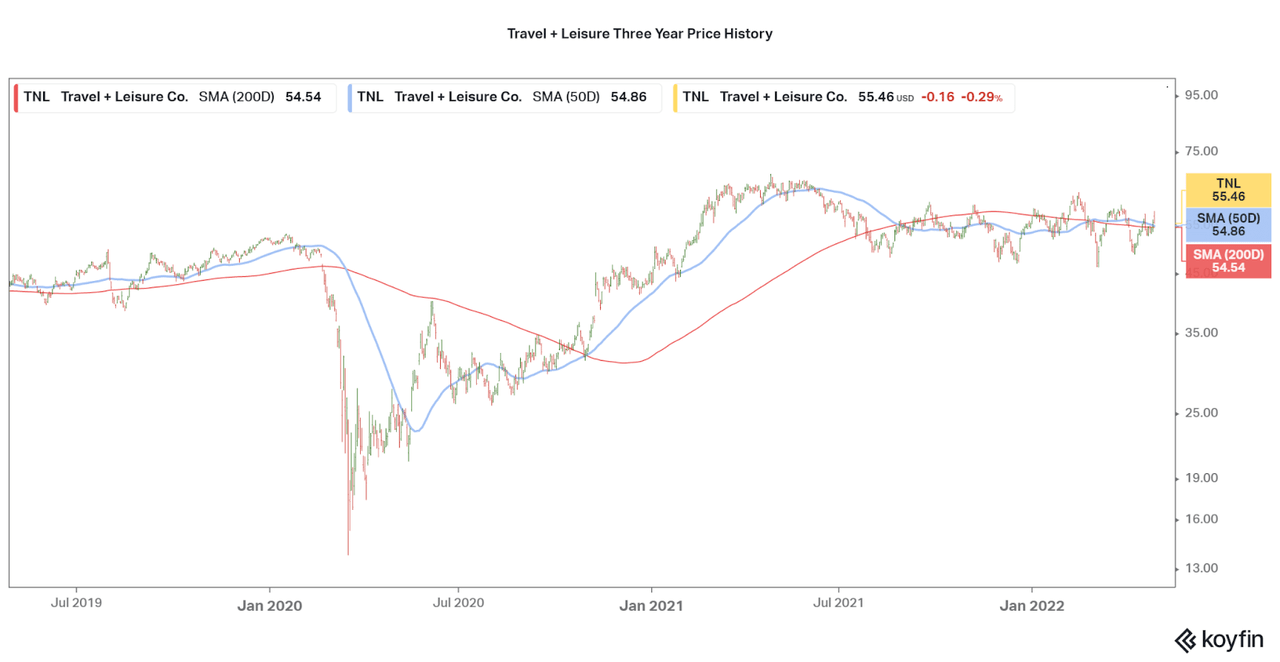

As the enterprise has had a significant alter with their inside structure, and the pandemic strike at the worst time, TNL‘s share rate has failed to reach highs witnessed prior to the pandemic. There was an original surge together with valuations previous summer months, but this speedily fell afterwards, whilst a keeping sample has emerged amongst $40 and $60 per share. Although it is really apparent to traders that they ought to have bought all through pandemic lows, we can also seem at the valuation of the company as potential aid for the expense.

Koyfin

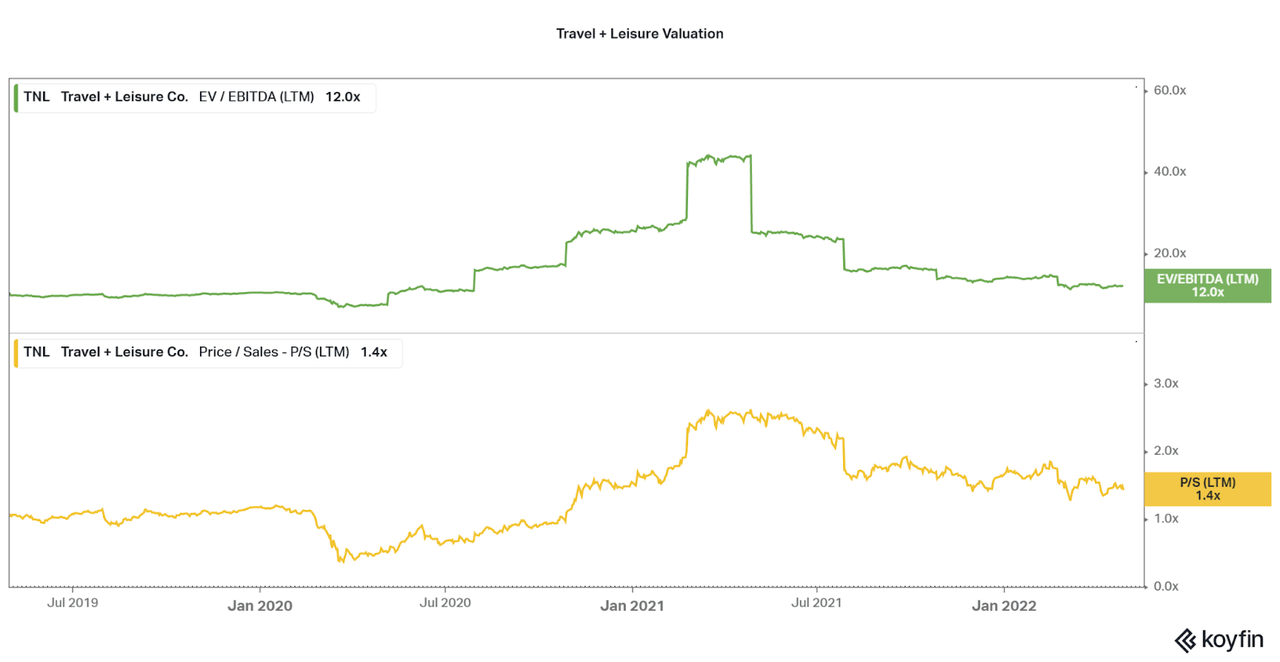

While the rate to earnings chart features very little perception and is excluded, the recent P/E of TNL is a meager 14.5 (TTM, GAAP). This implies the market is pricing in small growth for the firm, even as effectiveness returns. This is highlighted by the EV/EBITDA price of 12.0x, slipping steadily given that previous summertime. Further signs of weak spot are in the P/S, but due to the reduced revenues, continues to be earlier mentioned lows of 2019 and 2020. Any favorable revenue advancement and taken care of profitability will promptly travel the valuation reduced. As an investor, it will be vital to assess no matter whether values will carry on slipping, keep the same, or broaden. On the other hand, I like not to gamble, and I would contemplate the enterprise coming into into good or lower valuation territory from below.

Koyfin

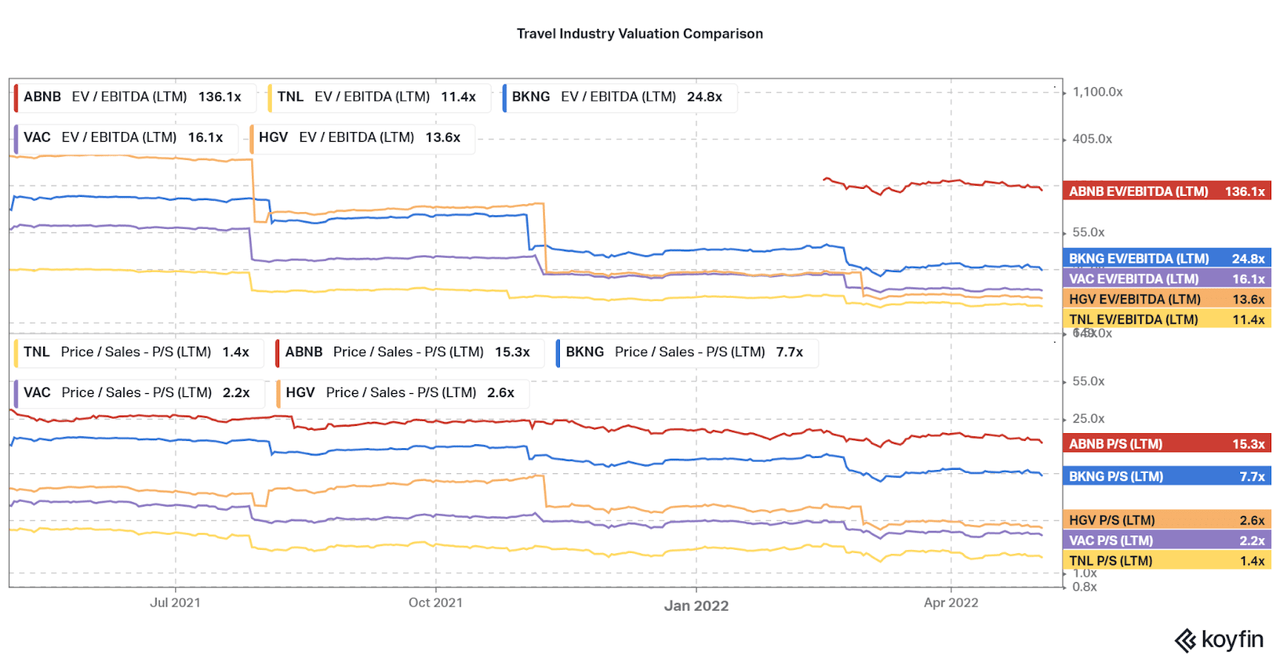

A further way to evaluate Journey + Leisure is by comparing the valuation to friends. While efficiency is tough to evaluate due to TNL‘s new status, it is simple to see that the organization holds a significantly lower valuation than any peer within the vacation marketplace, even other timeshare or itinerary vendors these as Hilton Grand Holidays (HGV) and Marriott Holidays (VAC). Meanwhile, booking platforms this kind of as Booking.com and Airbnb maintain far greater valuations, even as their own advancement costs falter. In this present market place period, lucrative, stable growth will hold a higher valuation, and this favors T+L as tourism returns in time. Of program, all of these names offer you a little different exposure to the current market, and will have to also be assessed for their personal merits.

Koyfin

Summary

I believe that that Travel + Leisure is a single of the a lot more exceptional stocks in the travel marketplace, and undoubtedly worth thought at recent valuations and upside opportunity. Whilst worries about even more COVID variants, worldwide travel, and even a recession weigh hefty on the outlook, T+L looks to be undertaking perfectly now that they are blended with Wyndham Places. Also, a rebranding of timeshares, and a reduction in their adverse qualities (this kind of as non-cancelable contracts), will let for a resurgence of the market much better than with friends. The newly proven responses loop of creating drive to journey (journal/web site), supplying travel organizing and concierge company (T+L Club), and then at last the better benefit timeshare ecosystem for all those who want the comprehensive expertise, is a good catalyst for the firm‘s opportunity. When I will be sitting on the sidelines for the minute, I may perhaps see an option to get if the share rate goes down a great deal even further.

Thanks for reading through, allow me know what you believe in the opinions.

More Stories

How to Prepare For an Adventure Holiday

Why Malta Is the Most Affordable Place for a Holiday Travel

All About Travel Agencies