Thomas Barwick/DigitalVision by means of Getty Photos

Journey + Leisure Co. (NYSE:TNL) has been working with troubles in excess of the earlier pair of a long time, thanks to COVID-19 pandemic and risky demand dynamics in the hospitality sector. As the financial state reopened so as well did Vacation + Leisure’s company but matters search set to stall once again. Investing in timeshare organizations at the beginning of a new enterprise cycle can normally present options for significant returns. Timeshares are a hugely cyclical sector so it performs each ways. In downturns, luxury significant-ticket products like timeshares get strike the toughest but the rebrand to Vacation + Leisure gave Wyndham Places a couple new tools to assist the enterprise cope in the course of tricky occasions like these. Now we are heading to acquire a glimpse at some of the hottest instruments and see how they could be benefiting traders in the in the vicinity of long run.

The Solution

Journey + Leisure is however a timeshare corporation, but their exceptional get on the product differentiates them. As an alternative of a classic timeshare, Travel + Leisure sells trip golf equipment. Associates can structure their very own holidays and they can use their possession in a amount of strategies. It was the Apple iphone instant for Vacation + Leisure. They also even now get upkeep costs for their timeshare offerings which is a practical type of passive earnings. This permitted the organization to target on creating a strong portfolio instead of getting and endorsing one pick location at a time.

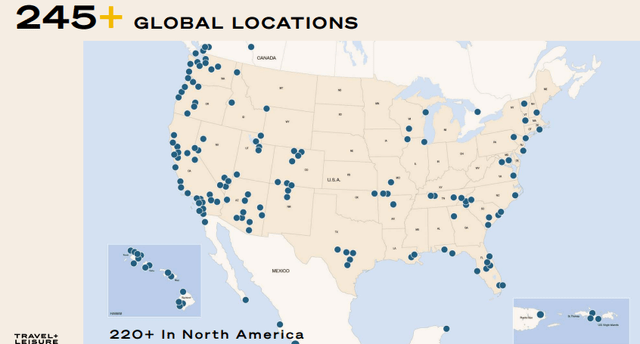

Acquiring a potent resort portfolio is high priced and makes a massive barrier to entry for competition as they have to go up versus an overall fleet of inns compared to just 1 appealing location and the TNL portfolio boasts some 245 places in some of the most interesting areas.

Vacation + Leisure

As a consequence, the value of timeshare stocks relies upon largely on the diversity of solutions and areas they offer you. Getting a deep spot catalog would make it more durable for level of competition to poach clients and is a big marketing stage for new buyers. It also presents shareholders confidence in the company’s ability to hold latest consumers. Travel + Leisure has performed perfectly building up its catalog.

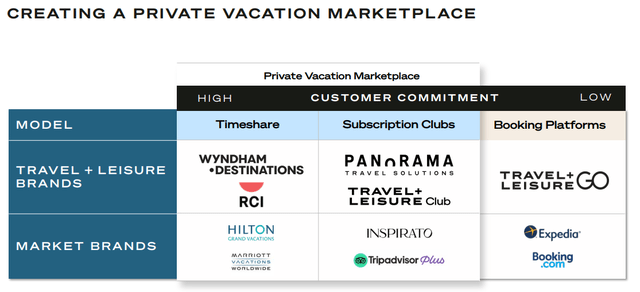

Journey + Leisure also has the RCI Trade that facilitates the buying and selling of timeshare- and it truly is a single of the world’s largest by quantity. They are effectively a one particular-halt shop for all factors timeshare and it often looks to be concerned in any revolutionary options in the place.

Some inquiries have been lifted about the timeshare industry’s potential to entice millennial cash, but there are some efforts underway that really should support it boost. Travel + Leisure began giving subscription services to millennials who are not as likely to dedicate to a very long-phrase expenditure. The introduction of Panorama’s subscription companies could be pivotal for Vacation + Leisure, primarily in light-weight of the latest levels of competition from Airbnb and other brief-time period lodging merchandise. Membership solutions could extremely nicely finish up getting the subsequent frontier in the timeshare market.

Vacation + Leisure

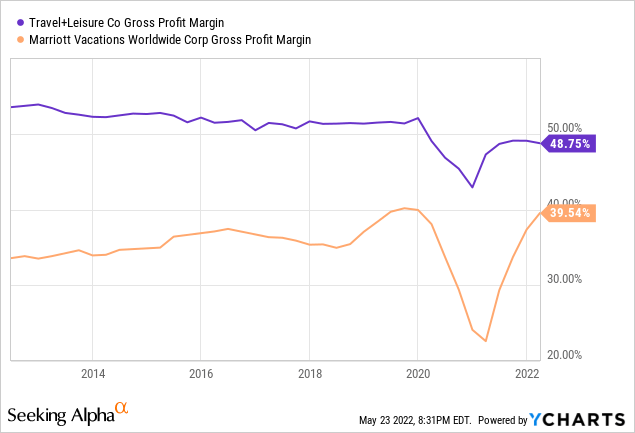

Solid Gross Margins Write-up Recovery

Many thanks to an enhanced price proposition relative to greater resort rates and solid work figures, TNL’s upcoming outlook is on the lookout promising.

The organization enjoys strong gross margins thanks to pricing electricity but they have been declining. The Wyndham Locations offerings exist at the medium stage of the pricing spectrum. In contrast to a lot more high-class offerings like the Marriott Holidays golf equipment, you would count on Travel + Leisure’s offerings to have a lot less favorable margins but they in fact outperform.

This is truly a testomony to the organizational efficiency of the management group. Charges have been able to balance out the expenditures, leading to higher revenues. Regulate above maintenance agreements and a sound commission-based mostly design allow for the corporation to correctly move on costs to shoppers.

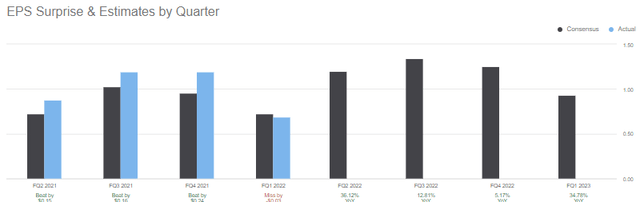

The restoration has actually taken root for the business. EPS tendencies have been favorable until a short while ago. The corporation has a cyclical ingredient to income and has recently been beating estimates for the most component.

Looking for Alpha

Most notably in their holiday possession business enterprise, the firm had an typical VPG (quantity for each visitor) of $3,377 in Q1 is better than at any time prior to for the company and 40% previously mentioned very last year’s figures. It is also essential to bear in mind that inflation is fantastic for their business. Fees for accommodations and holiday vacation residences are growing. This aids increase price to the timeshare strategy for individuals as it gets extra charge-productive relative to keeping in other styles of lodging. Interest charges mounting on the other hand are additional about.

Negative Problems for Cyclical Plays

Stories from the Federal Reserve advise that we are heading towards charge hikes between 3-5 moments this 12 months. This will be the 1st time charges have elevated since the begin of the pandemic-induced lockdowns and it could affect economic development and equity rates. What is far more, there is a inclination in the timeshare field to finance buys so a extended period of better fees will enhance the total price tag of VO products to the shopper.

Extensive-time period investors who preserve their eyes open really should have a lot of opportunities if they stay diversified. The industry has been obtaining extra unstable as rates rise and things get tenser abroad.

They have an effect on the volatility of shares and their multiples. When interest rates are substantial, stocks are much less attractive for the reason that they present decrease returns.

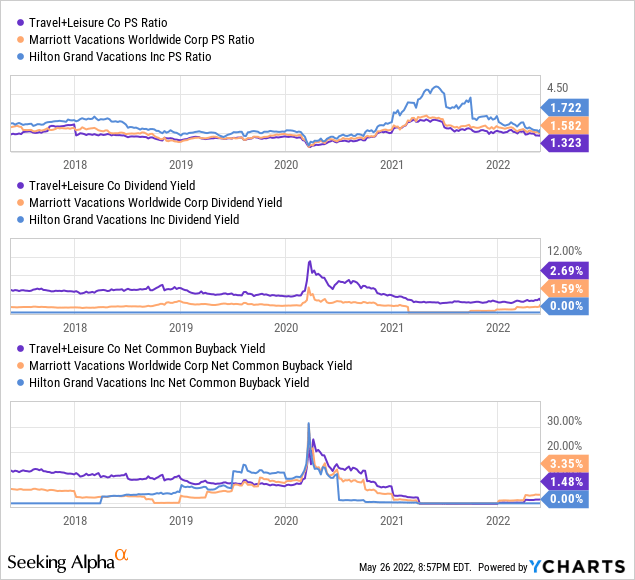

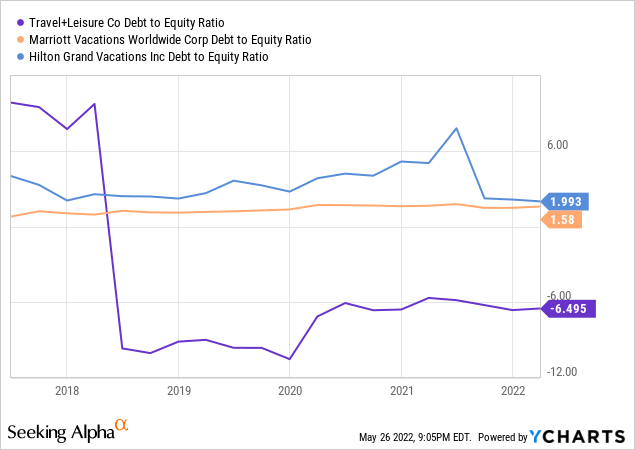

The hospitality sector is a person of the most influenced by fascination fees mainly because firms are inclined to have a large financial debt-to-fairness ratio.

This usually means that when desire charges go up, so does the price of borrowing income for these organizations. This puts timeshare providers in a rough place. They have to spend a lot more to borrow income due to the fact of the desire fees. They are inclined to stay clear of this by making comparatively secure agreements with set rates for revolving lines of credit rating. This is exactly where Travel + Leisure stands out against its friends. They have almost no credit card debt and no urgent have to have for liquidity injections. It is most likely that they might secure credit rating to beef up the equilibrium sheet if the economy was to go south in a massive way but the organization has done these kinds of a terrific career controlling its liquidity and in general value of money that this kind of a go must be rapidly forgiven if it were to transpire.

There is also the actuality that a recession is not all doom and gloom for much larger knowledge gamers like Travel + Leisure. There is frequently place for crucial acquisitions at advantageous price ranges and Wyndham has finished some remarkable specials in the earlier. Travel + Leisure is an outgrowth of the Wyndham brand name but it will be exciting to see if they can have comparable achievements in the celebration of a downturn.

Summary

Journey + Leisure is rather valued proper now. We could be going into a key slowdown and they contact hospitality a cyclical engage in for a purpose. I am under no circumstances heading to propose acquiring a timeshare stock on the cusp of a economic downturn but there is a lot to love about Journey + Leisure here. The stock has offered off a whole lot but it could however go decreased. I would not be in a hurry to obtain just nonetheless but I see no motive why investors ought to hurry to component with their shares at this stage. I rate the inventory as a Maintain.

More Stories

Why Malta Is the Most Affordable Place for a Holiday Travel

All About Travel Agencies

11 Ways To Organise Your Travel