Andrea Vumbaca/iStock by using Getty Images

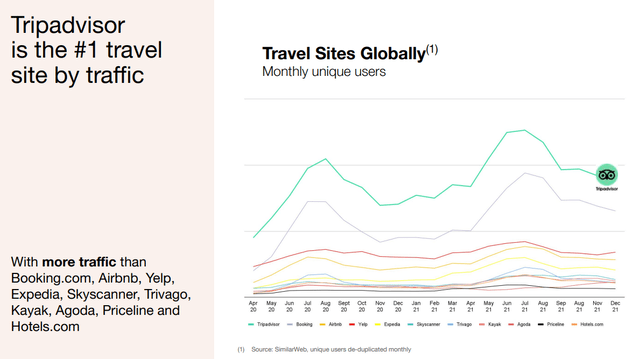

Tripadvisor (NASDAQ:Journey) is a company with so much opportunity. It is sad to see they are owning so significantly trouble monetizing the website. Unbelievably, it has far more visitors than even Booking.com (BKNG) or Airbnb (ABNB). Even so, the corporation has struggled to obtain the optimum company design to transform readers trying to find to examine assessments into earnings for the enterprise. Nonetheless, though low for the range of visits, the company does make some earnings and working income circulation, and we feel shares are at the moment quite cheap assuming travel recovers in 2022.

Tripadvisor Investor Presentation

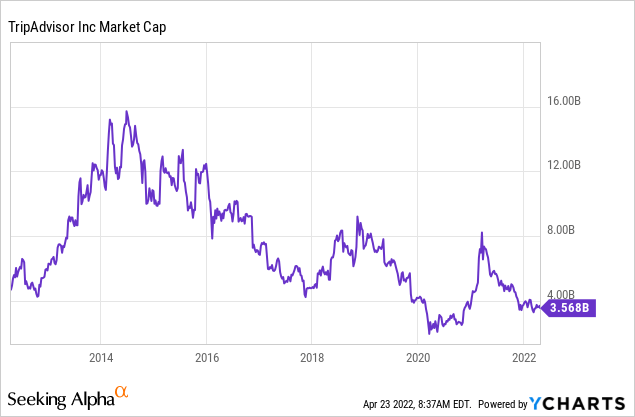

Tripadvisor is investing with a industry cap that is hardly ~3.5% that of Airbnb, which will make us imagine that if the firm does not determine out the ideal business product, then someone will in all probability supply to purchase them out and determine it out for them.

Administration tried to resolve the monetization problem by supplying a membership services identified as Tripadvisor Furthermore, but so considerably it has not genuinely met anticipations. The membership, which made available up-entrance resort bargains to subscribers for $99 per calendar year, ran into stiff opposition from significant lodge chains about charge parity concerns. It is at present transitioning to presenting a lot less interesting cashback payments after stays.

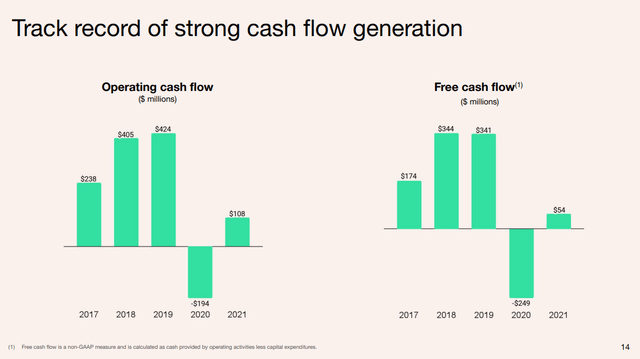

Pre-pandemic Tripadvisor was capable to make much more than $400 million for every calendar year in functioning cash movement, and more than $340 million in no cost funds stream. Comparing these figures to the present market cap, we see that the enterprise is scarcely buying and selling at ~10x this money flow amount. If there is a comprehensive travel recovery, the enterprise ought to in principle be equipped to deliver even extra income and totally free hard cash flow, provided that it took out extra than $200 million in expenses from its expense construction following the pandemic, and has claimed that a important part of these price savings should really continue being post-recovery.

Tripadvisor Trader Presentation

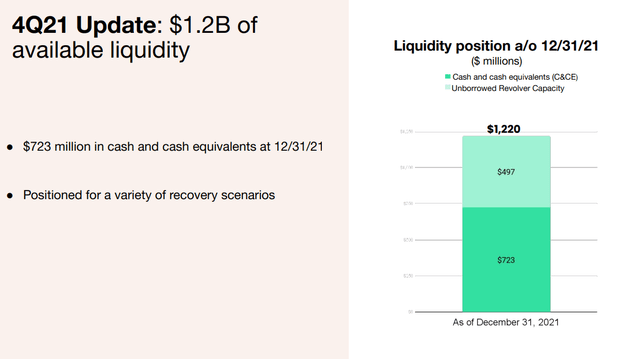

Luckily, the enterprise has ample liquidity to hold out for the journey restoration to get there, even if it is not in 2022, but in 2023 or 2024 in its place. Tripadvisor has far more than a billion pounds of liquidity amongst cash and equivalents, and unborrowed revolver ability.

Tripadvisor Investor Presentation

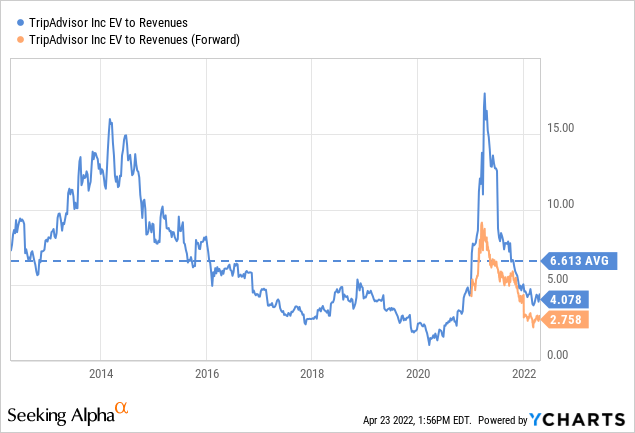

Valuation

We can see how lower the valuation has gotten by wanting at the EV/Revenues several and review it to its historical ordinary. This numerous is a lot more than a third under the regular, and the ahead several is significantly less than half this historical normal.

Analysts are anticipating earnings to drastically increase in the up coming pair of years. The normal estimate for FY24 is at the moment $2.34, which presents an FY24E P/E of 10.9x.

Searching for Alpha

Development and likely catalysts

There is expectation that in 2022 vacation will have recovered to 2019 stages, greatly benefiting the corporation. Specifically, as we outlined, many thanks to the costs it took out right immediately after the pandemic started. The company expects these discounts will go on even soon after a entire recovery. This really should make the company extra lucrative than it was pre-pandemic.

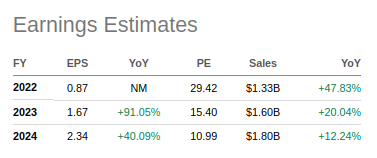

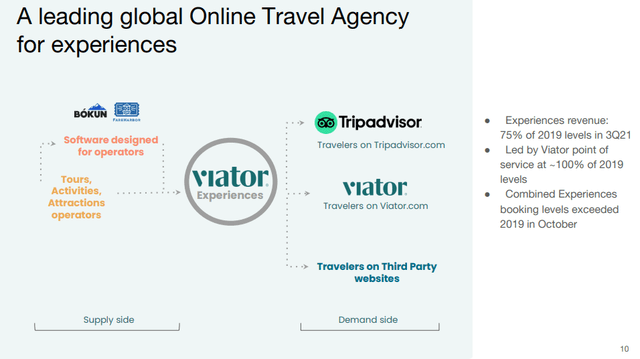

There are other prospective catalysts to unlock value past a possible takeover. 1 would be a productive re-developed membership company. While the to start with try at Tripadvisor In addition experienced difficulties, the enterprise is attempting to modify the item and to relaunch soon. Two other progress segments are Viator and LaFourchette. Viator is the primary marketplace for vacation encounters and has been growing at a really good rate. LaFourchette is a restaurant reservation application that will work mainly in Europe, comparable to OpenTable in the US current market. Both of these enterprises have observed a more quickly restoration than the main Tripadvisor Resort company. Tripadvisor is also contemplating marketing to general public shareholders a minority stake in Viator, with Tripadvisor retaining command of the brand name. This could unlock some value and show traders how substantially this small business is worth to the enterprise. Tripadvisor already filed a confidential S-1 draft registration statement with the SEC.

Liberty TripAdvisor Trader Presentation

Rivals GetYourGuide and Klook have been valued at much more than a billion dollars, so Viator could absolutely go the needle for Tripadvisor. In particular thinking of that Viator is regarded the leader of the booking experiences sector. Experiences reserving degrees exceeded 2019 stages in Oct 2021.

Liberty TripAdvisor Investor Presentation

TheFork (LaFourchette) operates in 12 international locations and partners with ~60,000 eating places to tackle reservations for them. It is one more Tripadvisor enterprise that is developing immediately and at some stage could also be considered for an IPO, a spin-off, or a sale.

Liberty TripAdvisor Trader Presentation

Summary

Tripadvisor shares are seriously low-priced, in particular if a complete journey restoration comes quickly. With the charges that have been taken out of the small business, it has the possible to be much more successful than ahead of, and the firm is experimenting with means to superior monetize its significant internet targeted traffic. There is also the risk that it may develop into an acquisition goal from a further enterprise that has some tips on how to monetize all the visits it receives. There is also a lot of value in some of the other firms Tripadvisor retains, these as Viator and TheFork.

More Stories

How to Select Guest Friendly Hotels

Ethiopia Adventure Travel Tips

Save Up To 45% Booking a Hotel Room – Comparing Prices Between Expedia and TravelBlock